“Fiscal Cliff Calculator” is the easiest tool to calculate and compare your income tax for pre-cliff-era and post-cliff-era. It gives you a clear side by side comparison of federal income tax, medicare (hospital insurance), and social security (OASDI). It not only shows numbers, but also gives the percentage of the change.

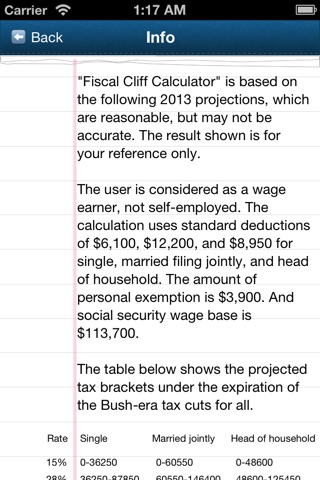

The calculation is based on the following 2013 projections. The result shown is for your reference only.

The user is considered as a wage earner, not self-employed. The calculation uses standard deductions of $6,100, $12,200, and $8,950 for single, married filing jointly, and head of household. The amount of personal exemption is $3,900. And social security wage base is $113,700. Medicare is 1.45% with the additional 0.9% on wages over $200k.